Welcome to the world of CRM for small accounting firms! As a small accounting firm, maximizing efficiency and achieving growth are crucial for success in today’s competitive market. With the right CRM (Customer Relationship Management) system in place, you can streamline your processes, improve client relationships, and ultimately drive your business forward. By harnessing the power of technology, you can automate repetitive tasks, track client interactions, and make data-driven decisions to optimize your operations. Let’s explore how CRM can revolutionize your small accounting firm and propel you towards success.

Benefits of CRM for Small Accounting Firms

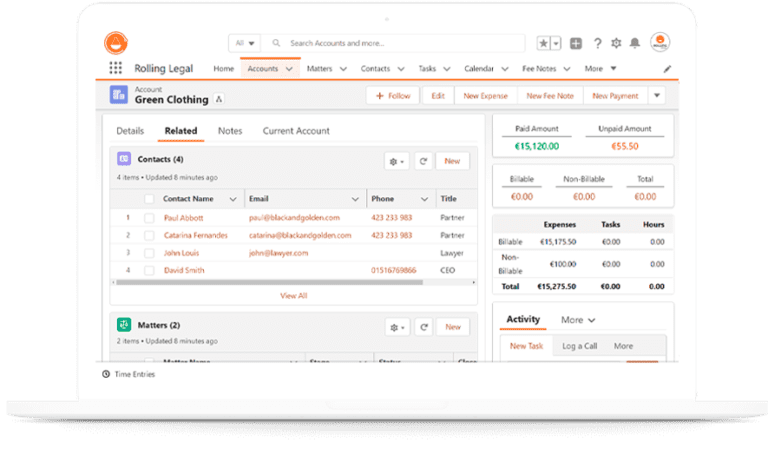

As a small accounting firm, implementing a Customer Relationship Management (CRM) system can bring numerous benefits to your business. CRM software is designed to help you manage your client relationships, streamline your processes, and increase overall efficiency. Here are some of the key advantages of using CRM for small accounting firms:

Improved Client Communication: CRM software enables you to centralize all client information in one place, making it easier to access and update information as needed. This can help you provide better and more personalized service to your clients, leading to increased satisfaction and loyalty.

Enhanced Organization and Efficiency: With CRM, you can automate many of your manual tasks, such as creating reports, sending reminders, and tracking client interactions. This helps you save time and increase productivity, allowing you to focus on more strategic activities that can drive growth for your firm.

Increased Sales and Revenue: By tracking client interactions and monitoring their needs and preferences, CRM can help you identify upsell and cross-sell opportunities. This can lead to increased sales and revenue for your firm, as well as improved client retention rates.

Better Collaboration and Teamwork: CRM software allows multiple team members to access and update client information in real-time, enabling better collaboration and teamwork within your firm. This helps ensure that everyone is on the same page and working towards common goals, ultimately improving the overall quality of your services.

Enhanced Data Security: CRM systems come with built-in security features that help protect sensitive client information from unauthorized access. This can give your clients peace of mind knowing that their data is secure and confidential, helping to build trust and credibility for your firm.

Improved Reporting and Analytics: With CRM, you can generate detailed reports and analytics on various aspects of your firm’s performance, such as client acquisition, retention, and profitability. This data can help you make more informed decisions and identify areas for improvement, leading to better overall business outcomes.

Overall, implementing a CRM system in your small accounting firm can help you improve client relationships, increase efficiency, drive revenue growth, and achieve greater success in today’s competitive market. Consider investing in CRM software to take your firm to the next level.

Choosing the Right CRM Software for Your Firm

When it comes to choosing the right CRM software for your small accounting firm, there are several factors to consider. The first step is to evaluate your specific needs and goals. What are you looking to achieve with the CRM software? Are you primarily looking to improve customer relationships, streamline communication, or track leads and conversions? Understanding your objectives will help you narrow down your options and find a software that is tailored to your firm’s needs.

Another important consideration when selecting CRM software is the size and complexity of your firm. Some CRM systems are designed for larger corporations with multiple departments and hundreds of employees, while others are better suited for small businesses with fewer staff members. It’s essential to choose a software that can easily be integrated into your existing systems and workflows without causing disruptions or requiring excessive training.

Cost is also a significant factor to consider when choosing CRM software. While some platforms offer a range of pricing options, including monthly subscriptions and pay-as-you-go plans, others require a significant upfront investment. It’s essential to weigh the costs against the benefits and choose a software that fits within your budget while still providing the features and functionality you need to succeed.

When researching CRM software options, it’s also crucial to consider the level of customer support and training that is available. Some platforms offer 24/7 customer service, while others may only provide support during regular business hours. Additionally, some companies offer training resources, such as online tutorials and webinars, to help you get the most out of your CRM software. Make sure to choose a platform that offers the level of support and training that aligns with your firm’s needs and capabilities.

Finally, it’s essential to consider the scalability of the CRM software. As your firm grows and evolves, you may need additional features and functionality to meet your changing needs. Choosing a platform that can grow with your business will save you time and money in the long run and ensure that you can continue to provide excellent service to your clients.

Implementing CRM Successfully in a Small Accounting Firm

Implementing a Customer Relationship Management (CRM) system in a small accounting firm can be a game-changer. It can streamline processes, improve client relationships, and ultimately lead to increased profitability. However, implementing CRM successfully requires careful planning and execution. Here are some key steps to ensure success:

1. Define Your Goals: Before implementing CRM, it’s important to clearly define your goals. What do you hope to achieve with the CRM system? Are you looking to improve client communication, increase efficiency, or boost sales? Understanding your objectives will help you choose the right CRM platform and tailor it to meet your specific needs.

2. Choose the Right CRM System: With so many CRM systems available, it’s essential to choose one that aligns with your firm’s requirements. Look for a system that is user-friendly, customizable, and integrates seamlessly with your existing software. Consider factors such as cost, scalability, and technical support when selecting a CRM system.

3. Train Your Team: One of the most critical aspects of implementing CRM successfully is employee training. Your team needs to understand how to use the CRM system effectively to reap its full benefits. Provide comprehensive training sessions, workshops, and resources to help your staff learn the ins and outs of the CRM system. Encourage employees to ask questions, experiment with the system, and provide feedback to ensure a smooth transition.

Additionally, consider appointing a CRM champion within your firm who can serve as a go-to person for support and guidance. This individual can help train new employees, troubleshoot issues, and continuously optimize the CRM system to meet your firm’s evolving needs.

4. Customize and Optimize: Once you’ve selected and implemented the CRM system, it’s essential to customize it to meet your firm’s unique requirements. Tailor the system to track client interactions, manage leads, and streamline processes specific to your accounting practice. Regularly review and optimize your CRM system to ensure it continues to align with your firm’s goals and objectives.

5. Monitor and Measure Success: To evaluate the effectiveness of your CRM implementation, regularly monitor key performance indicators (KPIs) and metrics. Track metrics such as client retention rates, lead conversion rates, and client satisfaction scores to gauge the impact of the CRM system on your firm’s performance. Use this data to make informed decisions, identify areas for improvement, and continuously refine your CRM strategy.

By following these steps and investing time and resources into implementing CRM successfully, your small accounting firm can unlock its full potential and achieve sustainable growth. Remember that successful CRM implementation is an ongoing process that requires dedication, collaboration, and a commitment to delivering exceptional client experiences.

Increasing Efficiency and Productivity with CRM

Implementing a Customer Relationship Management (CRM) system in a small accounting firm can significantly increase efficiency and productivity. With the right CRM software in place, accountants can streamline their workflow processes, automate repetitive tasks, and better manage client relationships. Here are some ways a CRM can help small accounting firms boost efficiency and productivity:

1. Improved Client Communication: A CRM system allows accounting firms to centralize client information, communication history, and important documents in one place. This makes it easier for accountants to access relevant information quickly and respond to client inquiries in a timely manner. By having all client interactions documented in the CRM, accountants can provide more personalized and attentive service to their clients.

2. Task Automation: CRM software can automate repetitive tasks such as sending out reminders for upcoming deadlines, scheduling appointments, and following up on client requests. By automating these routine tasks, accountants can free up time to focus on more strategic and value-added activities, ultimately increasing productivity.

3. Enhanced Collaboration: CRM systems enable team members to collaborate more effectively by sharing client information, notes, and tasks within the platform. This enhanced collaboration ensures that everyone is on the same page and working towards common goals. Additionally, team members can easily track the status of client projects, assign tasks, and communicate with each other through the CRM, fostering a more cohesive and efficient work environment.

4. Advanced Reporting and Analytics: One of the key benefits of using a CRM system in a small accounting firm is the ability to generate advanced reports and analytics. By tracking key performance indicators (KPIs) such as client retention rates, revenue growth, and project profitability, accountants can gain valuable insights into their business operations. These insights can help identify trends, spot opportunities for improvement, and make data-driven decisions to optimize firm performance.

With the right CRM software in place, small accounting firms can increase their efficiency and productivity by improving client communication, automating tasks, enhancing collaboration among team members, and leveraging advanced reporting and analytics capabilities. By harnessing the power of CRM technology, accountants can better manage their client relationships, streamline their workflow processes, and ultimately drive business growth.

Improving Client Relationships through CRM in Accounting

CRM (Customer Relationship Management) software is a valuable tool for small accounting firms looking to improve their client relationships. By utilizing CRM software, accounting firms can better manage client interactions, track communication history, and provide personalized services. Here are five ways how CRM can enhance client relationships in accounting:

1. Centralized Client Information: CRM software allows accounting firms to store all client information in one central database. This makes it easy for accountants to access important details such as client contact information, communication history, and service preferences. With all client information in one place, accountants can provide more personalized services and better meet client needs.

2. Improved Communication: CRM software streamlines communication between accountants and clients. Through automated email reminders, accountants can ensure that clients are kept up to date on important deadlines and appointments. Additionally, CRM software can track all client communications, making it easy for accountants to follow up on client inquiries and address any concerns promptly.

3. Tailored Services: CRM software allows accountants to track client preferences and tailor their services accordingly. By analyzing client data and interactions, accountants can identify opportunities for upselling additional services or providing customized solutions to meet client needs. This personalized approach helps build trust and loyalty with clients, leading to long-term relationships.

4. Efficient Task Management: CRM software helps accounting firms streamline their workflow and manage tasks efficiently. By setting reminders and deadlines within the CRM system, accountants can stay organized and prioritize client work effectively. This ensures that clients receive timely and accurate services, enhancing their overall satisfaction with the accounting firm.

5. Proactive Client Engagement: One of the key benefits of CRM software is its ability to track client interactions and identify potential opportunities for engagement. By analyzing client behavior and communication history, accountants can proactively reach out to clients with personalized offers or recommendations. This proactive approach not only strengthens client relationships but also increases client retention and satisfaction.

In conclusion, CRM software is a valuable tool for small accounting firms looking to improve client relationships. By centralizing client information, improving communication, tailoring services, managing tasks efficiently, and proactively engaging with clients, accounting firms can enhance their overall service quality and build long-lasting relationships with their clients. Investing in CRM software is a wise decision for small accounting firms looking to stay competitive in today’s market.

Originally posted 2025-02-18 18:00:00.